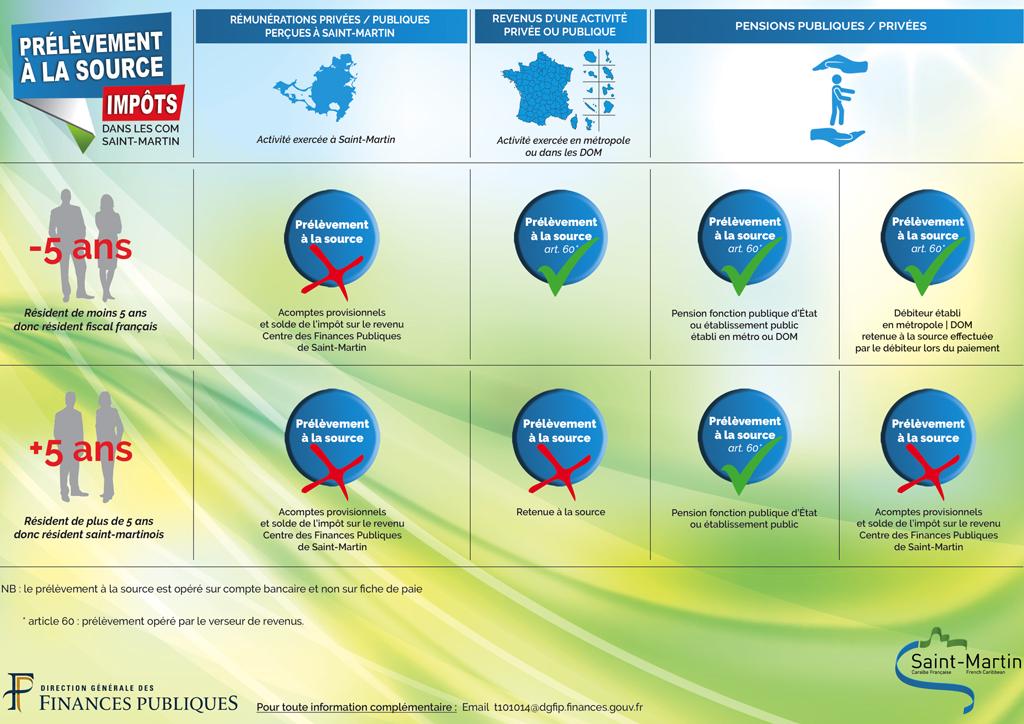

The Collectivity and the Center of Public Finances (CFP) of Saint-Martin would like to provide details on the withholding at source of income tax (PAS) implemented in Metropolitan France and in the DOM from the 1st January 2019. Explanations…

• When the activity is carried out in Saint-Martin, whether one is a Saint-Martin tax resident or not (5-year rule), income, whether from public or private sources, is not subject to withholding tax (PAS). Taxpayers must pay the installments and the balance of their tax at the Center des Finances Publiques de Saint-Martin.

• When the income comes from an activity carried out in mainland France or in the Overseas Departments (DOM), the 5-year rule applies. Thus, residents of less than 5 years on the territory of Saint-Martin will see their income deducted at source (PAS) according to article 60 of the national tax code: direct debit operated by the income giver on the bank account. Saint-Martin tax residents (present on the territory for more than 5 years) are not subject to withholding tax. Taxpayers must pay their installments and the balance of tax with the Center des Finances Publiques de Saint-Martin.

• Regarding taxation on public or private pensions, tax residents of mainland France or the overseas departments (- 5 years in Saint-Martin) are subject to the PAS. The tax on pensions from the state civil service or from a public establishment established in mainland France or the overseas departments is deducted at source (PAS) according to article 60 of the tax code. The tax on private pensions for residents of less than 5 years is withheld at source by the debtor established in mainland France or the French overseas departments, upon payment.

• With regard to taxation on public pensions, Saint-Martin tax residents (over 5 years in Saint-Martin) are subject to the PAS. The tax on pensions from the state civil service or from a public establishment is deducted at source (PAS) according to article 60 of the tax code. The tax on private pensions for Saint-Martin tax residents is not subject to withholding tax. Thus, taxpayers must pay their installments and the balance of their income tax with the Center des Finances Publiques de Saint-Martin.

For details: the implementation of the SAP at the national level will result in the elimination in Saint Martin of the monthly income tax levy. Taxpayers benefiting from the monthly payment must contact the Public Finance Center to find out about the new payment methods by installments and tax balance.

For further information, please contact the Public Finance Center: t101014@dgfip.finances.gouv.fr

7,191 total views

No comments